Free Accounting Software for

Small Businesses & Entrepreneurs

HMRC-recognised Making Tax Digital (MTD) software designed for effortless VAT and Income Tax filing.

Start for Free, No Credit Card Required

Who Is This For?

Sole Traders & Freelancers

Accountants & Bookkeepers

Landlords &

Property Managers

Your Entire MTD Workflow, Simplified

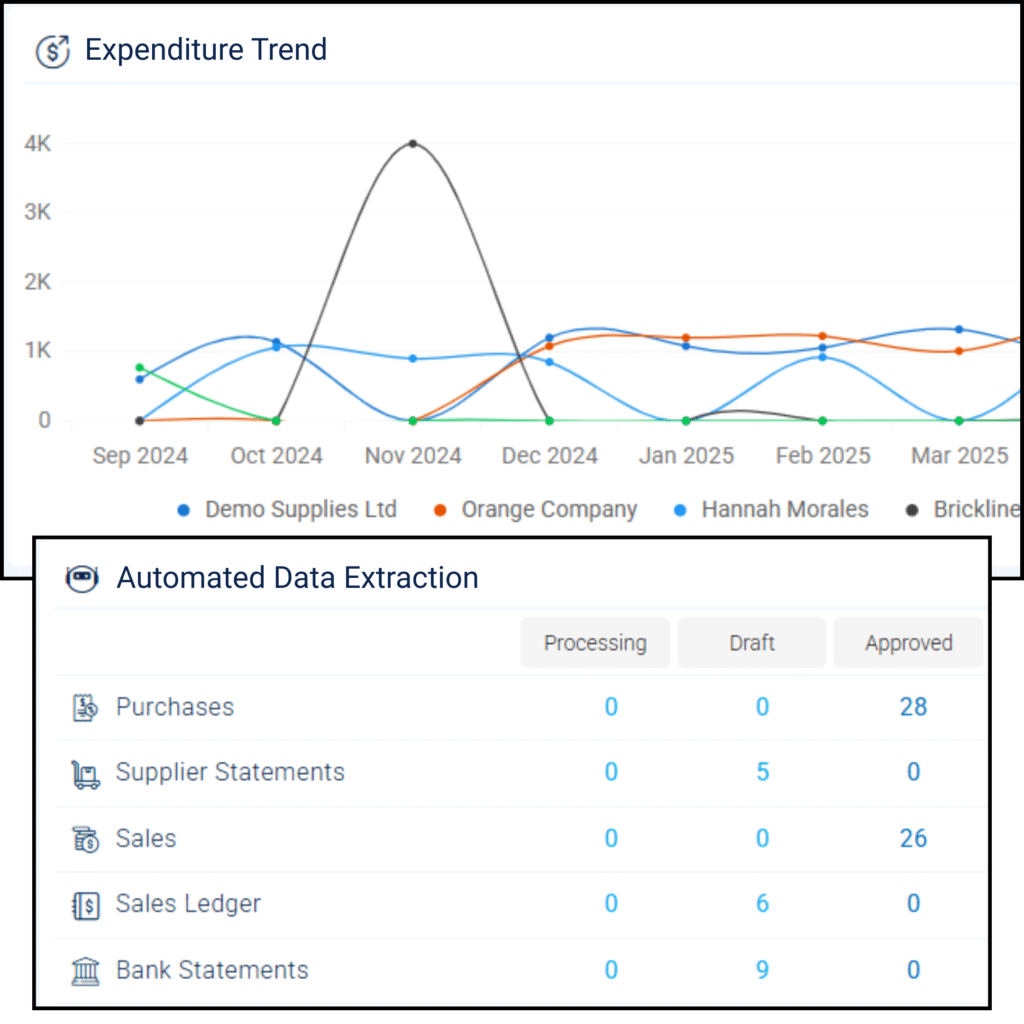

From handwritten ledgers to digital bank statements, Acxite automatically transforms your documents into accurate, MTD-compliant records.

Say goodbye to manual data entry.

MTD Bridging Software Tailored for Your Needs

Access our bridging software for MTD without any subscription fees. File your MTD VAT and Income Tax Self Assessment returns to HMRC. It’s genuinely free. Many consider this the best free Making Tax Digital software available.

Your Entire MTD Workflow, Simplified

From a shoebox of receipts to a successfully filed tax return, ACXITE handles every step.

Step 1

Record Transaction

Import CSV or upload scanned files (PDFs/images)—no manual typing from paper.

Step 2

Categorise Transactions

Categorise transactions and instantly prepare your VAT or MTD Income Tax return.

Step 3

Review & File to HMRC

Submit your return with a single click, fulfilling your Making Tax Digital obligations.

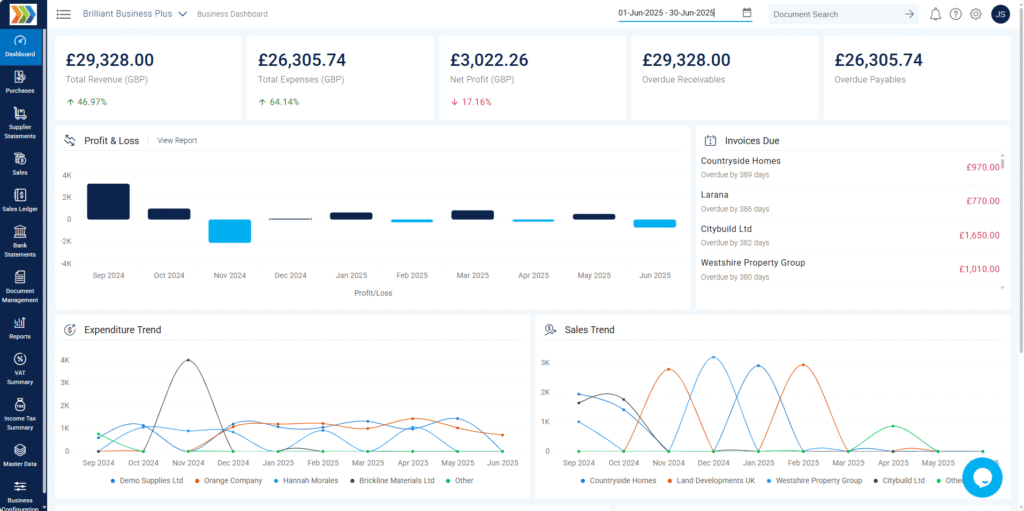

Go Beyond the Spreadsheet

Tired of manually entering every line from a bill or receipt into a tax spreadsheet?

Our unique strength is intelligent data capture. Scan a supplier bill or a pile of receipts, upload the file, and ACXITE will record the transactions for you.

Key Features

Everything you need for effortless compliance.

Discover why Acxite is considered the best MTD software for sole traders and accountants.